- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

Edexcel A Level Economics A:复习笔记3.4.5 Monopoly

Characteristics of Monopoly

- A monopoly is a market structure in which there is a single seller

- There are no substitute products

- The firm has complete market power & is able to set prices & control output

- This allows the firm to maximise supernormal profit in the short-run

- There is no long-run erosion of supernormal profit as competitors are unable to enter the industry

- High barriers to entry exist

- One of the main barriers is the ability of the monopoly to prevent any competition from entering the market

- E.g. by purchasing companies who are a potential threat

- One of the main barriers is the ability of the monopoly to prevent any competition from entering the market

- The UK Competition & Markets Authority defines a monopoly as any firm having more than 25% market share

- It acts to prevent this from happening in most industries

Profit Maximising Equilibrium

- As a single seller of goods/services, the firm in a monopoly market is also the entire market

- There is no differentiation between the firm & the industry

- It is a price maker

- This means that its revenue curves are downward sloping

- In order to maximise profits, it produces at the point where marginal cost (MC) = marginal revenue (MR)

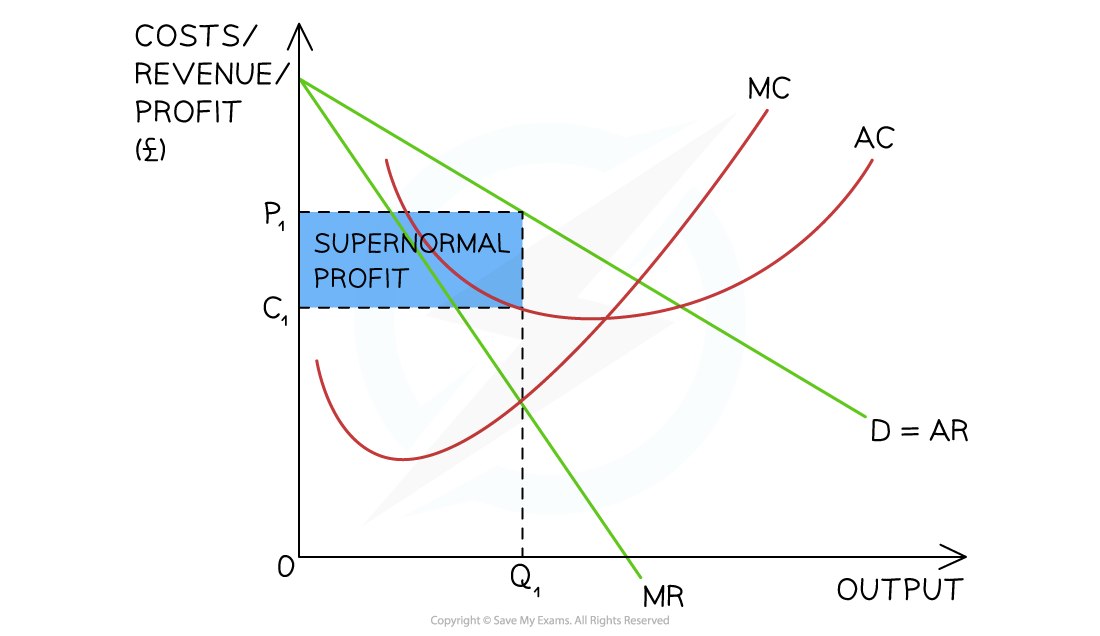

A diagram illustrating a monopoly making supernormal profit in the short-run & long-run as the AR > AC at the profit maximisation level of output (Q1)

Diagram Analysis

- The firm produces at the profit maximisation level of output where MC = MR (Q1)

- At this level the AR (P1) > AC (C1)

- The firm is making supernormal profit

Exam Tip

Some exam questions require application of your knowledge. E.g. You may be asked to draw a cost and revenue diagram to show the likely impact of a reduction in sales on profits. This requires you to modify the diagram presented above by shifting the demand curve inwards. You will draw a second AR & MR curve to the left of the existing ones & then illustrate the new level of profit.

Third Degree Price Discrimination

- Price discrimination occurs when a firm charges a different price for the same good/service in order to maximise its revenue

- There are different types (degrees) of price discrimination

- Third degree price discrimination occurs when a firm charges different prices to different consumers for the same good/service e.g. rail fares are priced differently depending on the time of travel

- Markets are often sub-divided based on time, age, income & geographic location

- Some airline ticket portals charge higher prices to customers using an Apple computer as they are likely to have higher income

The Following Conditions Must Be Met for Third Degree Price Discrimination to Occur

| Market Power | Varying Consumer Price Elasticity of Demand (PED) | Ability To Prevent Resale of Tickets |

| The firm must have the ability to change prices & it works best when there are no/few substitutes | Some consumers must be willing to pay more & the firm must be able to identify these different consumer groups i.e. split the market into sub-markets | It must be able to prevent consumers buying in the low-price sub-market & reselling in the higher ones |

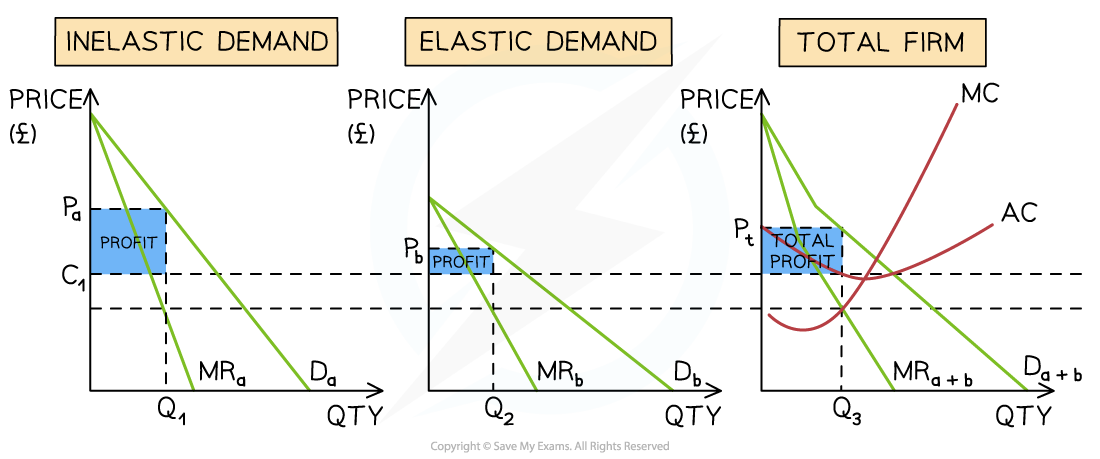

Illustrating Third Degree Price Discrimination

- In order to illustrate third degree price discrimination diagrammatically, the different sub-market diagrams are placed side by side

- The total market diagram is a combination of the sub-market diagrams

- The total profit is a combination of profits from the sub-markets

- The diagram below illustrates the market for rail travel in the UK where inelastic demand is 'peak' hour demand & elastic demand is any other time of the day i.e. 'off-peak'

A third-degree price discrimination diagram demonstrates a market that has been divided based on price inelastic (peak travel) & price elastic demand (off-peak travel). Following the revenue rule, prices are raised for peak demand & lowered for off-peak demand

Diagram Analysis

- Each train route has an effective monopoly provider

- The overall firm is producing at the profit maximising level of output where MC=MR

- This point is extrapolated to both sub-markets on the left by using the lower dotted line

- The average cost is extrapolated across both sub-markets using the upper dotted line (C1)

- A higher price for peak travel has been set at Pa & a lower price for off-peak travel has been set at Pb

- Following the revenue rule, total revenue increases in both markets

- The profit for sub-market A = (Pa-C1) * Q1

- The profit for sub-market B = (Pb-C1) * Q2

- The firm's total profit is the average selling price - the average costs

- Total profit = (Pt-C1) * Q3

- The firms' total profits are higher than if they had charged a single price to all customers

Costs & Benefits of Third-Degree Price Discrimination

Costs & Benefits of Third-Degree Price Discrimination to Consumers & Producers

| Consumers | Producers |

|

|

Costs & Benefits of Monopoly

- In several instances where the Competition & Markets Authority has acted to decrease/limit monopoly power, the firms have taken the Regulator to court to attempt to convince them that the firms market power will benefit consumers

- Theoretically this is possible, however in many cases the desire to maximise profits would prevent this from happening

The Advantages & Disadvantages Of Monopoly Power

| Stakeholder | Advantages | Disadvantages |

| The Firm |

|

|

| Employees |

|

|

| Consumers |

|

|

| Suppliers |

|

|

Natural Monopoly

- A natural monopoly occurs when the most efficient number of firms in the industry is one

- This is often due to associated infrastructure issues e.g. delivery of utility services like water where it does not make sense to have multiple pipelines

- It can also be due to the significant cost that is generated when entering the industry e.g. the sunk costs

- It can also be due to the ability of economies of scale to lower prices for consumers e.g. it makes sense to have one firm building five nuclear power stations as opposed to five firms as average costs will be lower with one firm producing

- Natural monopolies usually occur in utility industries & are regulated by the Government to ensure that consumers are not charged higher monopoly prices

- This regulation is often in the form of a maximum price

Exam Tip

When evaluating monopolies demonstrate critical thinking by acknowledging the positives as well as the negatives. For example, Amazon has partly become a monopoly by being very good at what they do & consumers benefit from lower prices & greater choice. However, this power means that they can also abuse the suppliers on their platform.

When evaluating natural monopolies, consider the government failure that may occur with regard to regulation & the imposition of maximum prices. There is a lot of disagreement about the level of profits that natural monopolies should be allowed to make. It is a normative issue.

转载自savemyexams

站内搜索

竞赛真题免费下载(点击下载)

在线登记

最新发布

© 2024. All Rights Reserved. 沪ICP备2023009024号-1