- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

Edexcel A Level Economics A:复习笔记3.3.4 Normal Profits, Supernormal Profits & Losses

Condition for Profit Maximisation

- To maximise profit firms should produce up to the level of output where marginal cost (MC) = marginal revenue (MR)

Calculations To Demonstrate the Profit Maximisation Rule

| Output | MR (£) | MC (£) | Addition to Profit |

| 5 | 50 | 32 | +18 |

| 6 | 50 | 36 | +14 |

| 7 | 50 | 50 | 0 |

| 8 | 50 | 68 | -18 |

Observations

- With the 7th unit of output, MC = MR & no additional profit can be extracted by producing another unit

- Up to the 6th unit of output, MC < MR & additional profit can still be extracted by producing an additional unit

- From the 8th unit of output, MC > MR & the firm has gone beyond the profit maximisation level of output

- It is making a marginal loss on each unit produced beyond the point where MC = MR

Normal Profit, Supernormal Profit & Losses

- When calculating costs, Economists consider both the explicit and implicit costs of production

- Explicit costs are the costs which have to be paid e.g raw materials, wages etc.

- Implicit costs are the opportunity costs of production

- This is the cost of the next best alternative to employing the firm's resources

- E.g. if an investor puts £1m into producing bicycles & they could have put it in the bank to receive 5% interest, then the 5% represents an implicit cost

- Implicit costs must be considered as entrepreneurs will rationally reallocate resources when greater profits can be made elsewhere

- Profit = total revenue (TR) - total costs (TC)

- Total costs include explicit and implicit costs

- Normal profit occurs when TR = TC

- This is also called breakeven

- Supernormal profit occurs when TR > TC

- A loss occurs when TR < TC

Calculations To Demonstrate Profits

| Output | TR (£) | TC (£) | Profit (TR - TC) |

| 5 | 150 | 70 | 80 |

| 6 | 180 | 96 | 84 |

| 7 | 220 | 220 | 0 |

| 8 | 250 | 270 | -20 |

Observations

- Supernormal profit occurs up to the 6th unit of output

- Normal profits occur at the 7th unit

- From the 8th unit, the firm is making a loss

Short-run & Long-run Shut-down Points

- Firms do not always make a profit & may endure losses for a period

- Entrepreneurs often keep firms going in the hope that market conditions will change & demand for their products will increase leading to profitability

- This raises the question, 'when is it the best time for a firm to shut down?'

- The shut-down rule provides the answer by considering both the long-run & short-run periods

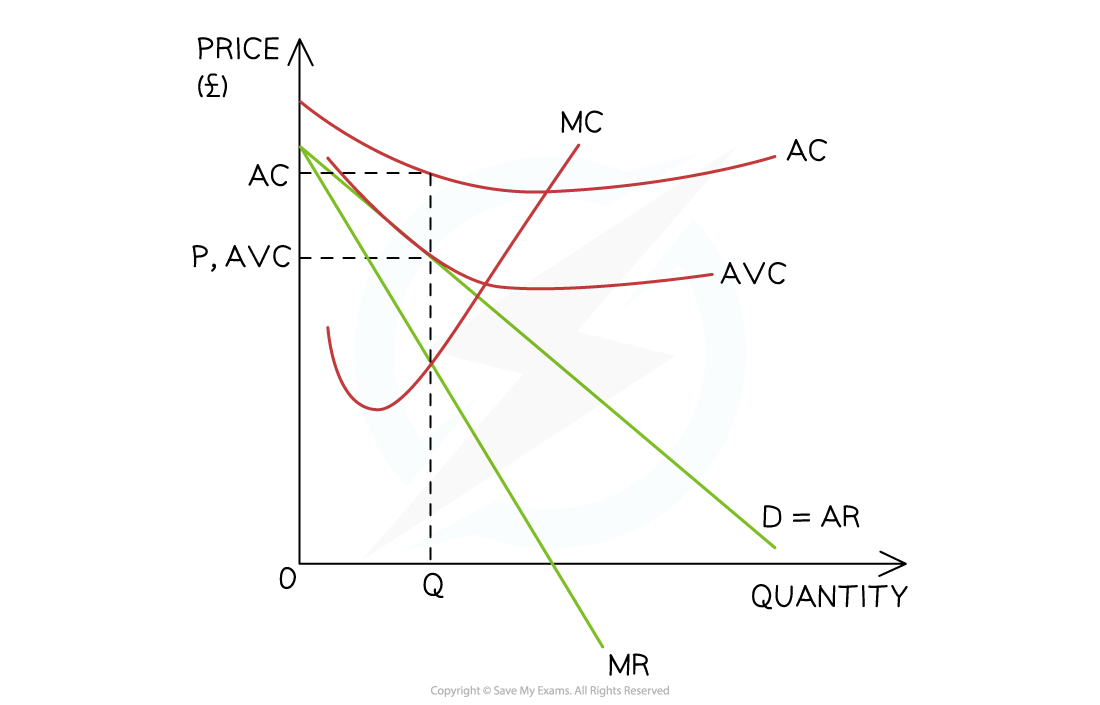

The Short-run Shut Down Point

- In the short-run, if the selling price (average revenue) is higher than the average variable cost (AVC), the firm should keep producing (AR > AVC)

- If the selling price (AR) falls to the AVC it should shut down (AR = AVC)

A firm should shut down in the short-run if the selling price (AR) is unable to cover the AVC

Diagram analysis

- The firm produces at the profit maximisation level of output (Q) where MC=MR

- At this level, the P = AVC

- This means that there is no contribution towards the firm's fixed costs

- The selling price literally only covers the cost of the raw materials used in production

- There is no point in continuing production & the firm should shut down

- This means that there is no contribution towards the firm's fixed costs

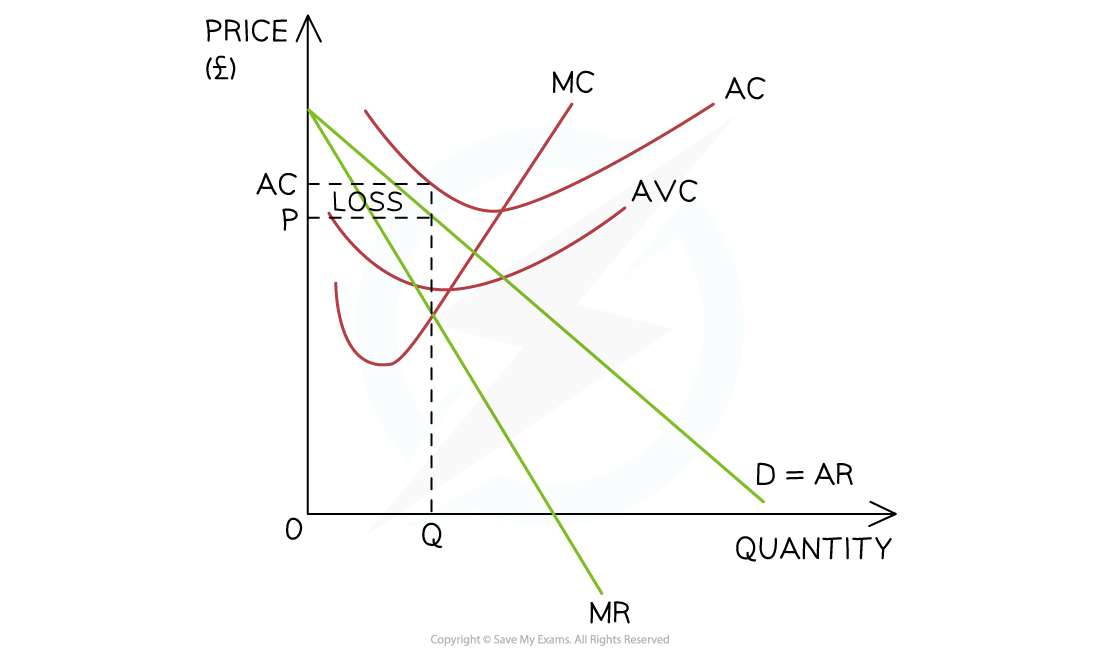

The Long-run Shut Down Point

- In the long-run, if the selling price (AR) is higher than the average cost (AC) the firm should remain open (AR > AC)

- if the selling price (AR) is equal to or lower than the average cost (AC), the firm should shut down (AR = AC)

A firm should shut down in the long-run if the selling price (AR) is unable to cover the AC

Diagram analysis

- The firm produces at the profit maximisation level of output (Q) where MC=MR

- At this level, P < AC

- It could continue operating in the short-run as the AR > AVC, but in the long-run they are making a loss & the firm will shut down

转载自savemyexams

站内搜索

竞赛真题免费下载(点击下载)

在线登记

最新发布

© 2024. All Rights Reserved. 沪ICP备2023009024号-1