- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

Edexcel A Level Economics A:复习笔记3.2.1 Business Objectives

Profit & Revenue Maximisation

Profit Maximisation

- Most firms have the rational business objective of profit maximisation

- Profits benefit shareholders as they receive dividends & also increase the underlying share price

- An increase in the underlying share price increases the wealth of the shareholder

- Profits benefit shareholders as they receive dividends & also increase the underlying share price

- To achieve profit maximisation firms, follow the profit maximisation rule

- When marginal cost (MC) = marginal revenue (MR) then no additional profit can be extracted by producing another unit of output

- When MC < MR additional profit can still be extracted by producing an additional unit of output

- When MC > MR the firm has gone beyond the profit maximisation level of output

- It is making a marginal loss on each unit produced beyond the point where MC = MR

- In reality, firms may find it difficult to produce at the profit maximisation level of output

- They may not know where this level is

- In the short term they may not adjust their prices if the marginal cost changes

- Marginal costs can change regularly and regular price changes would be disruptive to customers

- In the long-term firms will seek to adjust prices to the profit maximisation level of output

- Firms may be forced to change prices by the Competition Commission

- The profit maximisation level of output often results in high prices for consumers

- Changing prices changes the marginal revenue

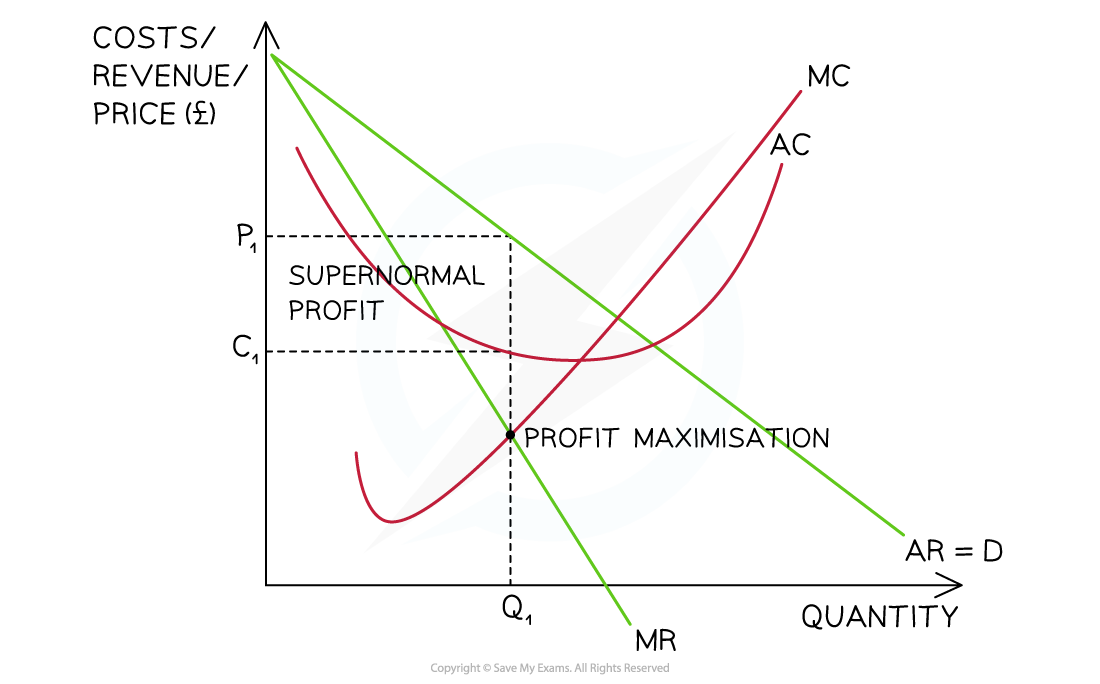

The profit maximisation level of output occurs at Q1 where MC = MR resulting in a market price of P1

Diagram Analysis

- This firm has market power as the MR and average revenue (AR) curve are downward sloping

- At the profit maximisation level of output (MC = MR)

- The selling price is P1

- The average cost is C1

- The supernormal profit =