- 翰林提供学术活动、国际课程、科研项目一站式留学背景提升服务!

- 400 888 0080

Edexcel A Level Economics A:复习笔记2.6.1 Possible Macroeconomic Objectives

Economic Growth

- Economic growth is a central macroeconomic aim of most governments

- Many developed nations (UK included) have an annual target rate of 2-3%

- This is considered to be sustainable growth

- Growth at this rate is less likely to cause excessive demand pull inflation

- Politicians often use it as a metric of the effectiveness of their policies and leadership

- Economic growth has positive impacts on confidence, consumption, investment, employment, incomes, living standards and government budgets

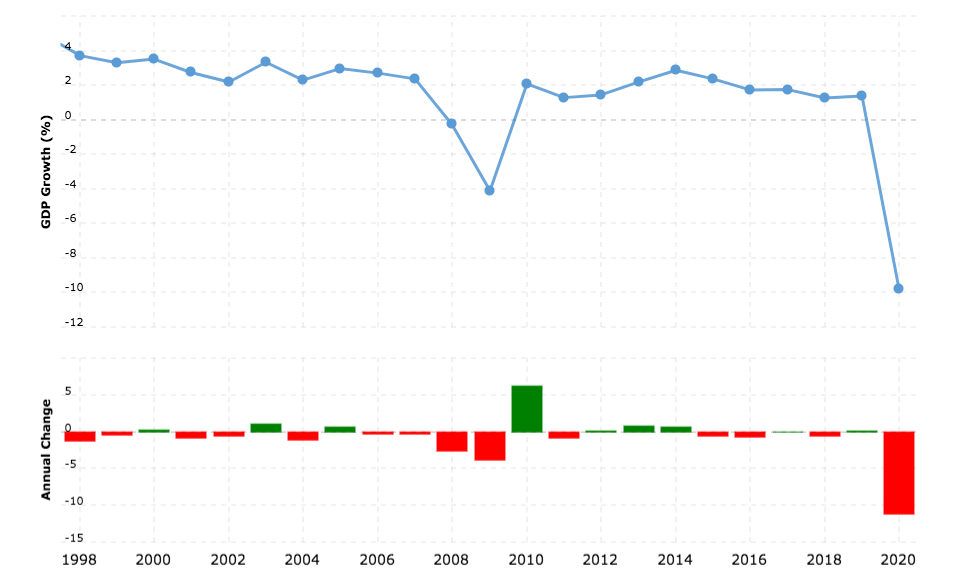

A diagram showing the economic growth rate of the UK since 1998

Source: Macrotrends

A Table Highlighting Some of the Economic Growth Trends in the UK Since 1998

| 1998-2007 | 2008-2015 | 2016-2019 | 2020 - |

|

Steady growth fluctuating between 2-4% |

Global financial crisis followed by rapid bounce back due to government intervention - and then steady growth | Gradual disinflation possibly due to future expectations regarding the impact of the Brexit vote | Supply chain issues due to Brexit. Decreased consumption due to the impact of Covid 19. These created a deep recession (short-lived due to government intervention) |

Low Unemployment

- The target unemployment rate for the UK is 4-5%

- This is close to the full employment level of labour (YFE)

- There will always be a level of frictional unemployment

- This makes it impossible to achieve 100% employment

- Different economies have different rates that are considered to be close to the full employment level of labour e.g. Japan's level is about 2.5%

- Within the broader unemployment rate, there is an increased emphasis on the unemployment rate within different sections of the population

- E.g. youth unemployment, ethnic/racial unemployment by group

- In 2021, black unemployment in the UK was 11% and white unemployment was 4.%

- E.g. youth unemployment, ethnic/racial unemployment by group

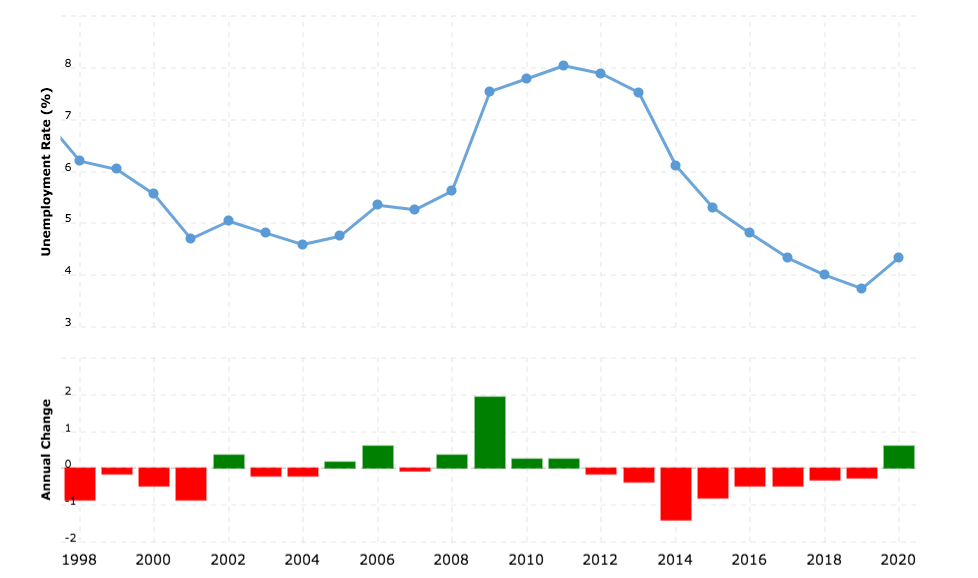

A diagram showing the unemployment rate in the UK from 1998 - 2020

Source: Macrotrends

- Unemployment tends to be inversely proportional to real GDP growth

- When real GDP increases, unemployment falls

- When real GDP decreases, unemployment rises

- Unemployment in the UK remained relatively high for the six years following the global financial crisis of 2007

Low & Stable Rate of Inflation

- The UK has a target inflation rate of 2% using the Consumer Price Index (CPI)

- A low rate of inflation is desirable as it is a symptom of economic growth

- The different causes of inflation (cost push or demand pull) require different policy responses from the Government

- Demand-side policies ease demand pull inflation

- Supply-side policies ease cost push inflation

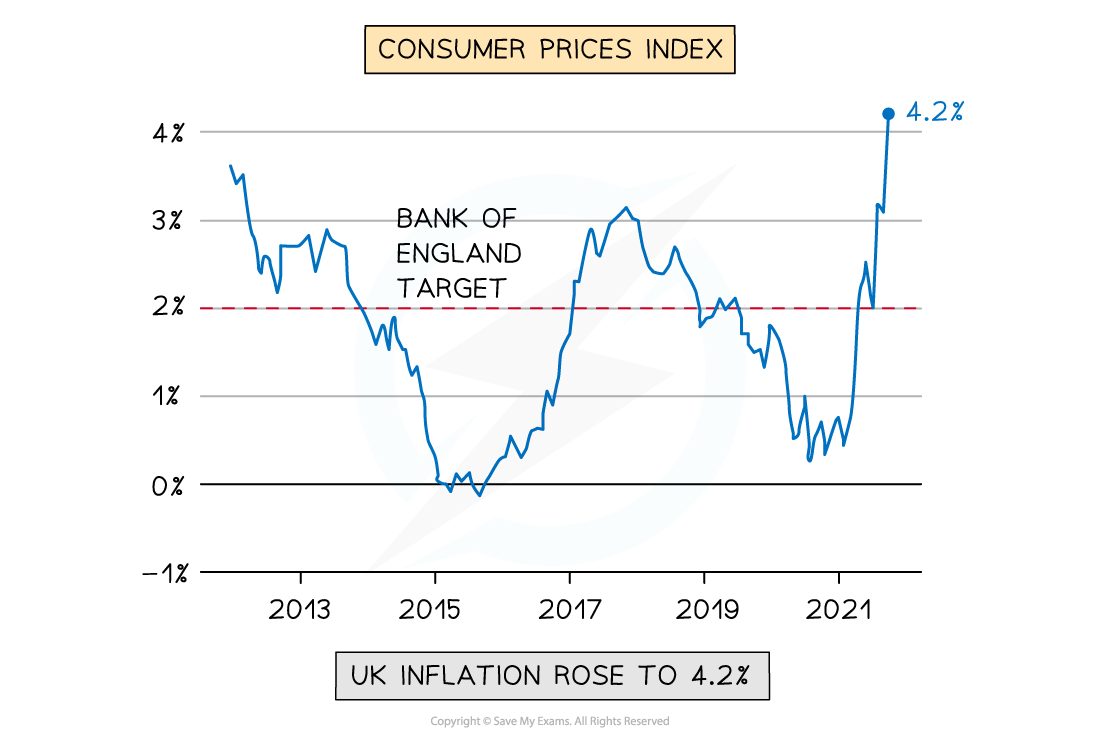

A diagram illustrating the inflation rate in the UK from 2012 to 2021 using the CPI

- In the UK, a continual deviation from the target of 2% would not be considered as stable

- An inflation rate in April 2022 of 4-5% was considered to be unstable, eroding household purchasing power

- A low & stable rate of inflation is important as it

- Allows firms to confidently plan for future investment

- Offers price stability to consumers

Balance of Payments Equilibrium On The Current Account

- The Balance of Payments (BoP) for a country is a record of all the financial transactions that occur between it and the rest of the world

- The current account focuses mainly on the financial transactions related to exports and imports of goods/services

- Governments aim for Balance of Payments equilibrium on the Current Account

- If exports > imports it will create a current account surplus

- If imports > exports, it will create a current account deficit

- Each one of these conditions has advantages/disadvantages associated with it

- However, a current account deficit is more problematic in the long-run

- The UK has traditionally run a small deficit

- As a % of GDP the UK current account deficit is insignificant so has not been problematic

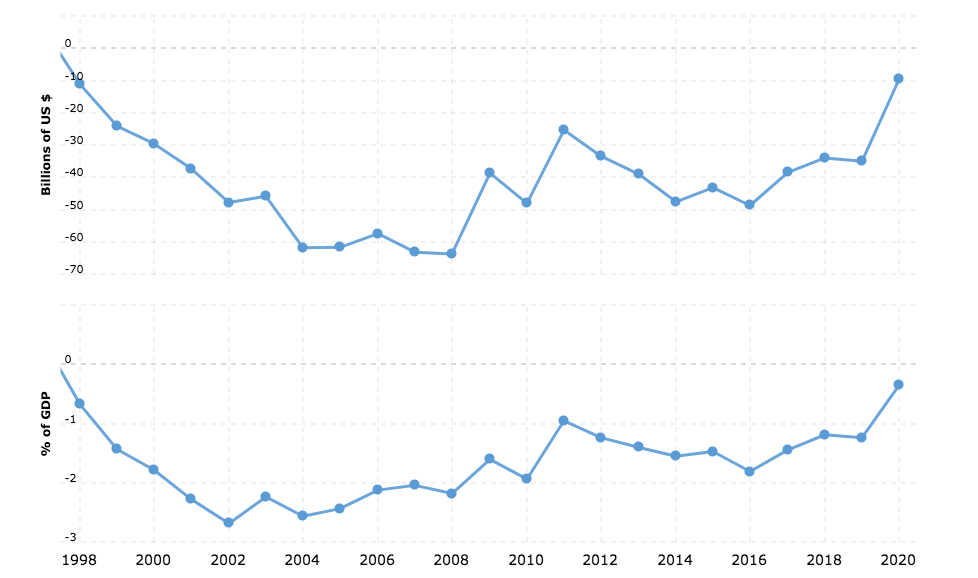

A diagram showing the UK Trade Deficit from 1998 to 2020. The bottom graph illustrates the trade deficit as a % of GDP and the top one illustrates the absolute value expressed in US$

Source: Macrotrends

- In the diagram above the trade deficit has been falling steadily since 2016

- During this time period the value of exports was increasing slightly faster than the value of imports

Balanced Government Budget

- The Government Budget is presented annually and includes the forecasted revenue and expenditure

- Revenue comes from the sale of assets, taxes, sales revenue from goods/services e.g. train tickets

- Expenditure includes all government spending such as public sector salaries; unemployment benefits; spending on public & merit goods

- The UK Government aims to run a balanced budget

- If expenditure > revenue, there is a budget deficit

- Any deficit has to be financed through public sector borrowing

- Any borrowing is added to the public sector debt (Government debt)

- If the UK Government debt becomes too high (expressed as a % of GDP), then lenders begin to lose confidence in the Government's ability to repay the debt

- The Government then has to raise the interest rate it offers to lenders, which makes borrowing more expensive

- The UK Government has worked extremely hard recently to reduce the budget deficit and run a balanced budget

- Covid 19 expenditure has eroded the progress they made

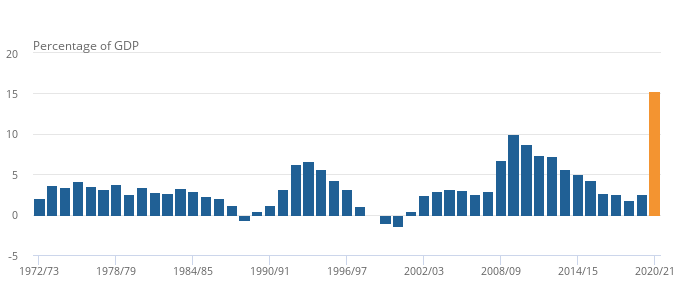

Government deficit (net borrowing) as a percentage of GDP - 1973 to 2021

Source: ONS

- Reducing the deficit can mean tough choices for the economy

- E.g. cutting public sector pay; raising taxes; reducing unemployment benefits; reducing spending on merit goods

- The significant deficit increase in the 2020/21 budget due to Covid 19 will need to be repaid

- The short-term help offered through the crisis may generate long-term pain as the Government seeks to cut future spending so as to repay the debt

Environmental Protection

- In April 2021, the UK Government stated that their environmental aim was to reduce emissions by 78% by 2035

- This reduction is based on the emission levels of 1990

- It is one of the most ambitious climate change targets globally

- It includes the UK’s share of international aviation and shipping emissions

- Broader environmental aims include

- A focus on sustainability

- The reduction of negative externalities of production

- 100% energy from renewable sources by 2035

Greater Income Equality

- The reduction of income inequality remains a high priority

- High levels of income inequality create social unrest and can ultimately lead to revolutions

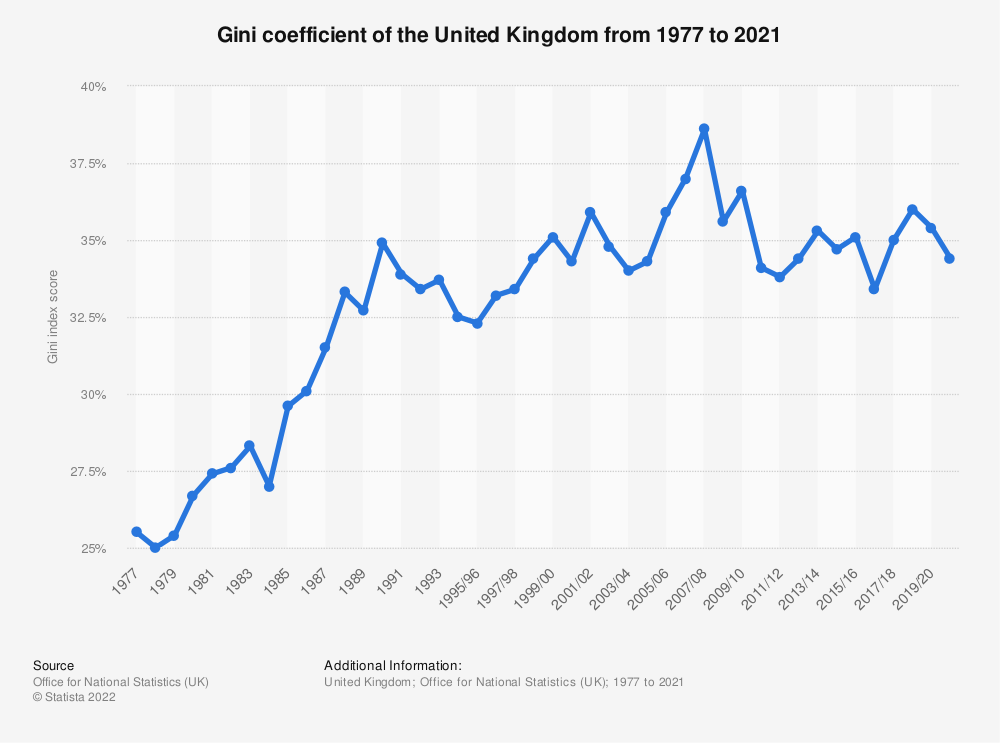

- Income inequality is measured using the Gini Coefficient

- Most developed economies have a Gini target of 0.3-0.4

- Perfect income equality is not desirable as it removes the incentive to work and study

- Unchecked capitalism has a natural outcome of high income inequality

- The wealthy are able to keep buying factors of production

- The concentration of ownership becomes more and more narrow with fewer individuals owning the bulk of the world's wealth

- There is a need for the UK government to intervene to maintain acceptable levels of income inequality

A diagram showing the general increase in income inequality in the Uk since 1977

Source: ONS

- In the diagram above, the Gini coefficient has been multiplied by 100 to create percentage

- 34% would equate to a coefficient of 0.34

- Absolute poverty is worse in developing countries. However, In a developed economy such as the UK, a 1% increase in income inequality can push a lot more households into absolute poverty

转载自savemyexams

站内搜索

竞赛真题免费下载(点击下载)

在线登记

最新发布

© 2024. All Rights Reserved. 沪ICP备2023009024号-1